In QuickBooks Online, you might have the characteristic of “Payroll” that may save your effort and cash. By putting in place payroll in QuickBooks Online, you point out who you require to be paying payroll tax returns and payroll taxes and submitting taxes. QuickBooks recommends probably the most following payroll answers:

- Enhanced Payroll.

- Basic Payroll.

- Assisted Payroll.

We show to you the way easy putting in place payroll in QuickBooks Online can also be.

The measure of time that it’s going to take you to arrange payroll will depend on your collection of staff. To spare you a while, you will have to plan to have a couple of bits of knowledge useful ahead of you start.

Below is a tick list that you’ll be able to use to be sure to have the entire data you’re going to want. We will get started with the employer data after which talk about the tips referring to putting in place payroll in QuickBooks payroll on-line.

Employer’s Information

- Bank Account Info – The complete routing quantity and account collection of the bank account that you’re going to write payroll tests from in addition to make your payroll tax bills.

- Worker Compensation – Hourly wages, pay charges, rewards, commissions, guidelines and a few different pay you give your representatives. To absorb extra about the best way to make a decision the forms of pay you will have to be offering.

- Employee Benefits – Health and dental coverage, 401(ok), retirement designs, get-away/burnt up depart means or Flexible Spending Account (FSA). To absorb extra about the best way to make a decision the types of benefits you will have to be offering, have a look at our employee advantages direct

- Different Additions/Deductions – Cash propels, mileage/shuttle reimbursement, affiliation contribution, salary garnishments.

Employee’s Information

- Form W-4 – Upon contracting any other consultant, you want them to complete a W-Four shape which gives you their withholding data and different suitable information you require holding in thoughts the tip purpose to successfully confirm their finance assess derivations.

- Pay Rate – The hourly fee or pay you to pay each and every consultant along any praise or fee pay, if subject matter.

- Deductions – Employee commitments to scientific protection, retirement designs, or garnishments.

- Pay Schedule – through and big, this can be week after week, each and every different week, semi-month to month or month to month. You can likewise arrange a large number of repayment plans within the match that you need to in QuickBooks. For example, at the off likelihood that you just pay hourly employees constantly and repayment representatives every different week you’ll be able to set either one of those repayment plans.

- Sick/Vacation hours’ technique and modify – If you be offering in poor health/holiday pay you will have to input this knowledge in for each and every consultant. As a rule, those hours can be earned every payroll period.

- Contract / Hiring Date – The contract/hiring date for each and every worker should be entered amid the finance setup.

- Direct Deposit Authorization Form – You can be offering your representatives an instantaneous deposit in lieu of a test. To do as such, you will have them end an instantaneous deposit approval shape which now not simply will provide you with the authorization to make an instantaneous deposit to their checking account however it’s going to additionally come with the checking account and course data that you’re going to wish to make the deposit.

Setting up Payroll in QuickBooks Online

Since you might have the better a part of the tips you require, it’s a really perfect alternative to transport up the ones sleeves and get the danger to paintings!

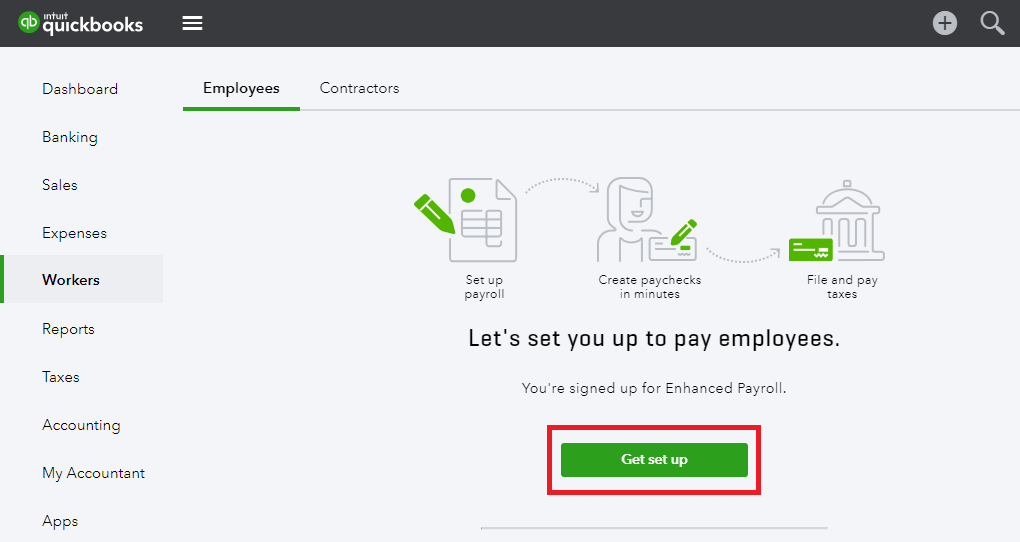

Step 1: Go to the Employees Center

Click at the Workers tab positioned at the left menu bar as indicated within the screenshot underneath:

Step 2: Proceed to the Payroll Setup

In the development that you just bought payroll together with your QuickBooks Online club, at that time your display will take after the only within the display seize underneath. Tap the “Get arrange” catch to proceed to the next display.

Step 3: Respond to Questions Regarding Prior Payrolls

In the development that you’re converting over to QuickBooks from a handbook/automatic payroll device you then will have to give some further information to make sure that your W-2 bureaucracy are precise.

The following is a display seize of the inquiries that you just will have to react to along a temporary explanation of every.

- Have you paid any W-2 representatives in 20XX? – This inquiry is in point of fact undeniable as day. On the off likelihood that you’ve paid representatives this 12 months, choose “sure:” If that is the primary instance if you end up paying employees this 12 months, choose “no”.

- At the purpose when will, you first run payroll with QuickBooks Online Payroll? Indicate the date that you just intend to run your first payroll in QuickBooks. The choices that display up right here can be based at the provide date.

- How may just you pay your staff?- Indicate the way in which wherein you paid your employees for your handbook/previous framework. Your response to this inquiry is important in mild of the truth that at the off likelihood that you just paid staff and withheld fees from their paychecks, you will have to give the year-to-date finance information for each and every employee afterward within the setup.

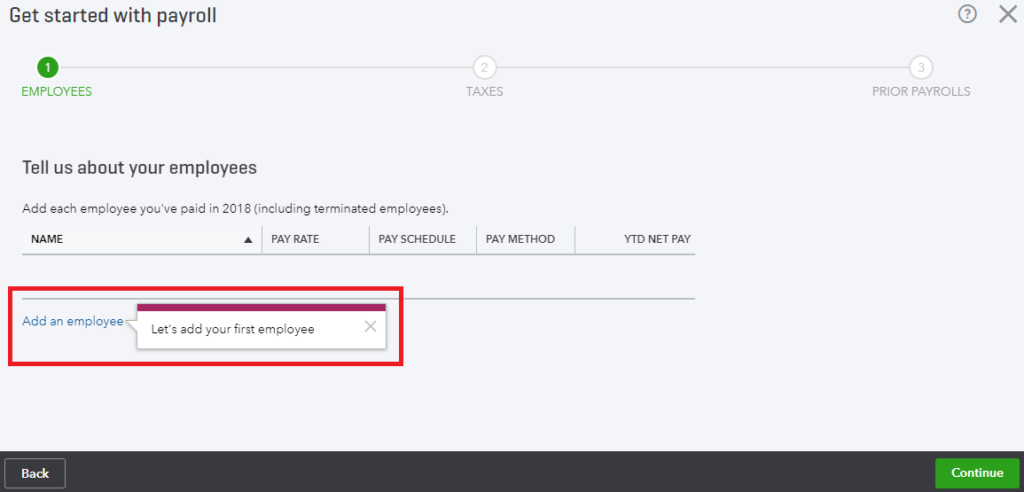

Step 4: Add Employees

Click on “Add an worker” as indicated within the screenshot underneath.

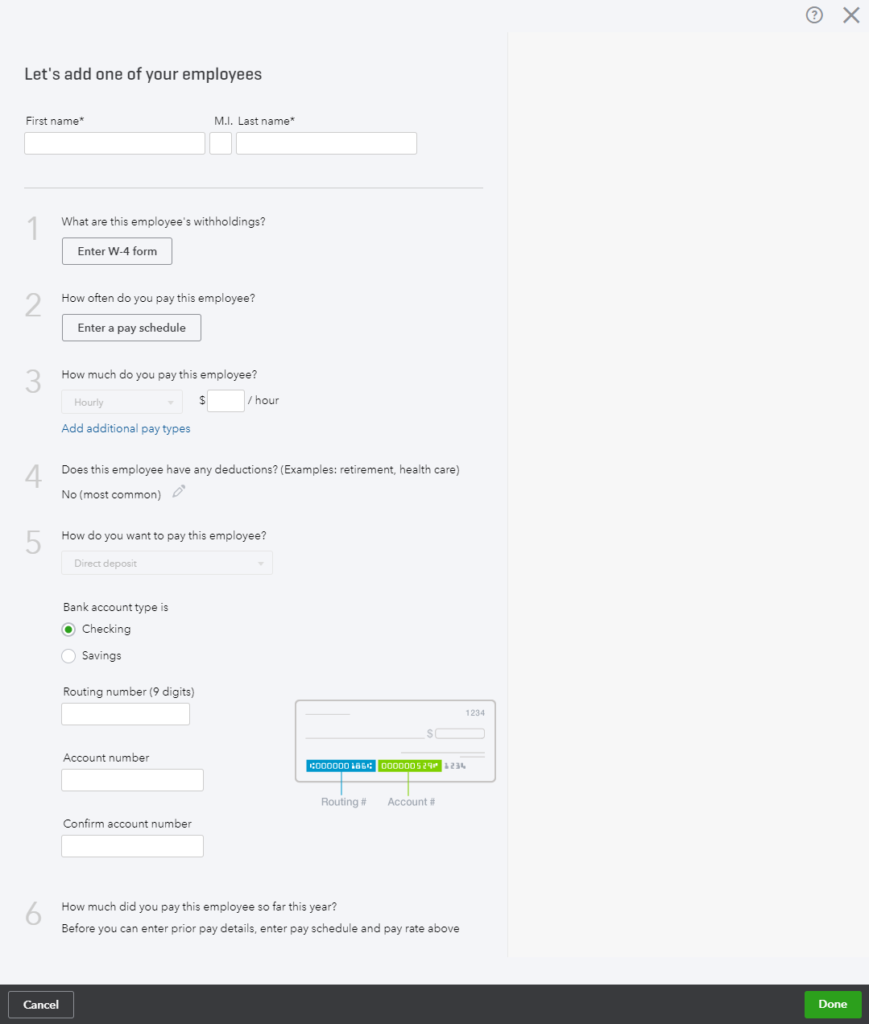

Step 5: Complete Employee Information

Complete the fields as indicated within the screenshot underneath:

- Employee Withholding Info – This information will originate from Form W-4, which we tested prior. When you click on at the pencil signal, the above display will display.

- Pay Schedule – From the drop-down, choose the repayment plan for the employee. (i.e. Week after week, Every different Friday, Monthly and so on)

- Employee Pay – Enter the worker’s salary on this box.

- Employee Deductions/Contribution – Select the deductions/contributions for the worker as indicated within the screenshot underneath.

- Payment Method – Select both direct deposit or are living test from the drop-down. In the development that you choose direct deposit, input the employee’s saving cash information in particular from the quick direct deposit authorization shape we mentioned already.

- Enter year-to-date payroll data – In the development that you just paid this employee this 12 months, input their YTD finance data from their remaining finance have a look at a subject of the previous device as demonstrated within the display seize beneath.

Once you might have finished the above steps, test the tips and click on Done.

Now that you’ve effectively finished your Payroll Setup, you might be all set to pay your staff!